.@0xfluid DEX V2 launches this month, here’s everything you need to know before it flips every other DEX in a few weeks.

Fluid DEX V1 launched just a year ago, focused purely on correlated pairs, USDT/USDC, wBTC/cbBTC, ETH/wstETH, and so on.

Fluid DEX sources liquidity directly from the lending layer. When you borrow against collateral, that position is simultaneously used to facilitate trading and generate extra fees, meaning part of your borrow interest is literally paid by traders.

This setup worked flawlessly for correlated assets. Fluid DEX did over $155B in volume in its first year, generated $25M in annual fees, and contributed ~20% of total Fluid treasury revenue.

It quickly captured 35% of market share on Ethereum, with only a few of correlated pairs. So imagine what will happen when volatile pairs go live?

Today, it accounts for 53.3% of all USDC-USDT Ethereum trades.

79% of all GHO-USDC trades

89% of all sUSDe-USDT trades.

I can go on and on but you get the drill by now. Fluid has become the second-largest DEX on Ethereum by volume and the third across all chains, again, just by focusing on correlated pairs. Its market share in those pairs hasn’t stopped climbing since launch.

Other DEXs like Uniswap or Curve have to constantly incentivize LPs with high APYs to keep liquidity. Fluid doesn’t. Capital is already there, deposited and borrowed against, and the trading fees are pure bonus yield. That lets Fluid offer the lowest fees and beat competitors.

This creates a flywheel:

Better yields + best borrowing conditions → more deposits → more liquidity → more trading volume → higher market share -> Higher yields -> repeat

Since DEX V1 launch, Fluid Lending’s TVL grew from $700M to $5.5B across EVM and Solana (via @jup_lend), a ~700% increase.

And that’s while focusing ONLY on correlated pairs.

V2 launches this month, opening the doors to volatile pairs (concentrated liquidity, custom price ranges, dynamic fees, etc).

Fluid is on track to become the #1 DEX by Q1-2026 across all of DeFi, on every major chain.

Oh, and all that revenue is used for buybacks, which I expect to at least double in a year.

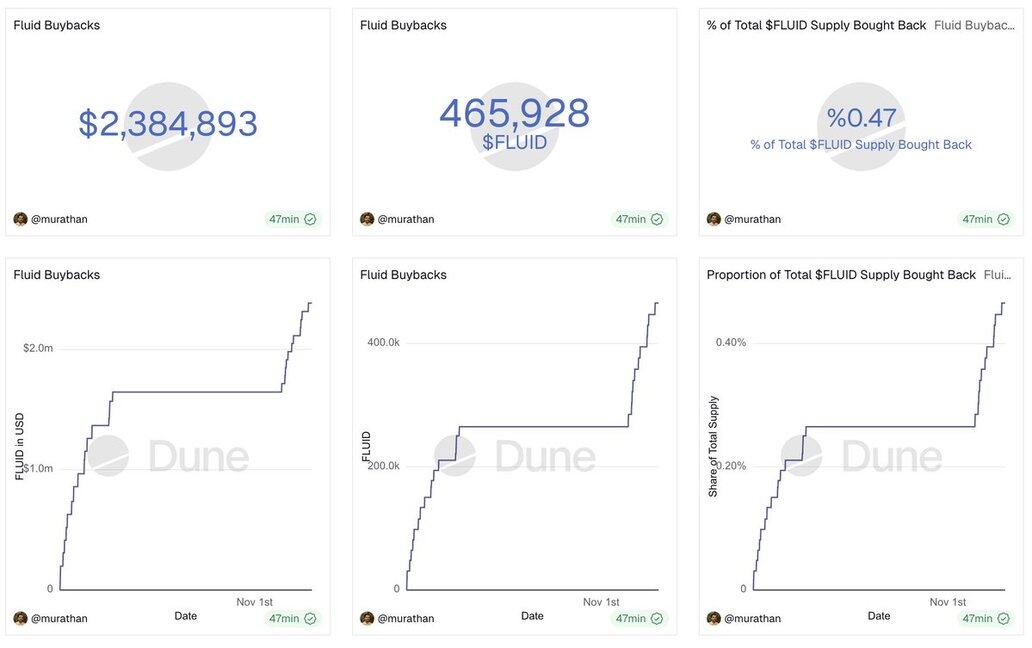

@0xfluid 0.47% of total supply is bought back in just ~40 days of revenue buybacks. This does not include revenue from @jup_lend yet.

6.67 ألف

42

المحتوى الوارد في هذه الصفحة مُقدَّم من أطراف ثالثة. وما لم يُذكَر خلاف ذلك، فإن OKX ليست مُؤلِّفة المقالة (المقالات) المذكورة ولا تُطالِب بأي حقوق نشر وتأليف للمواد. المحتوى مٌقدَّم لأغراض إعلامية ولا يُمثِّل آراء OKX، وليس الغرض منه أن يكون تأييدًا من أي نوع، ولا يجب اعتباره مشورة استثمارية أو التماسًا لشراء الأصول الرقمية أو بيعها. إلى الحد الذي يُستخدَم فيه الذكاء الاصطناعي التوليدي لتقديم مُلخصَّات أو معلومات أخرى، قد يكون هذا المحتوى الناتج عن الذكاء الاصطناعي غير دقيق أو غير مُتسِق. من فضلك اقرأ المقالة ذات الصِلة بهذا الشأن لمزيدٍ من التفاصيل والمعلومات. OKX ليست مسؤولة عن المحتوى الوارد في مواقع الأطراف الثالثة. والاحتفاظ بالأصول الرقمية، بما في ذلك العملات المستقرة ورموز NFT، فيه درجة عالية من المخاطر وهو عُرضة للتقلُّب الشديد. وعليك التفكير جيِّدًا فيما إذا كان تداوُل الأصول الرقمية أو الاحتفاظ بها مناسبًا لك في ظل ظروفك المالية.