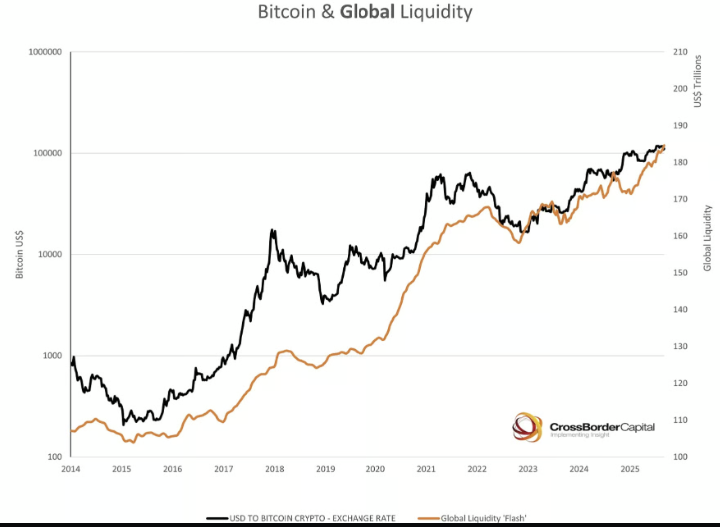

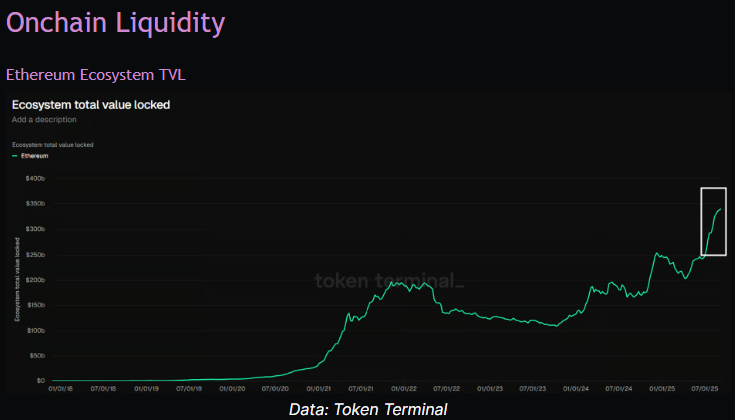

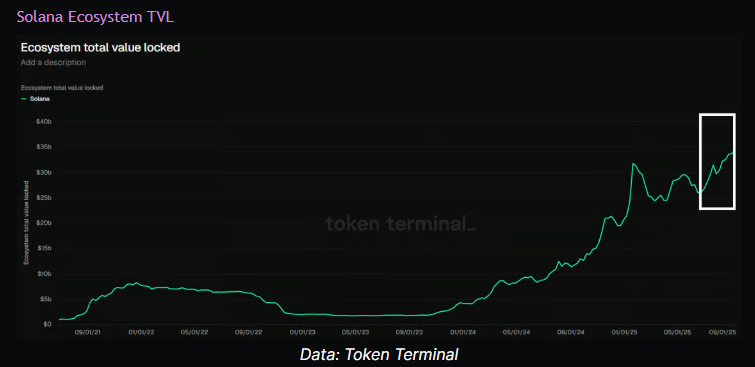

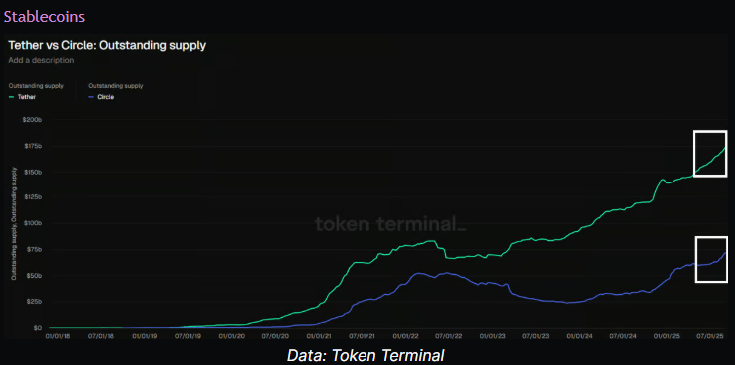

Global liquidity and onchain liquidity continue to grind higher. Case & Point: 1. Global Liquidity: recently reached a new all-time high of $184.6b with a three-month annualized growth rate of 13.3% (4.1% annualized) *driven by a reduction in bond market volatility as measured by the Move Index + slowing QT out of Europe and the BOJ 2. Onchain Liquidity: Ethereum ecosystem TVL is up nearly 35% over the last few months as stablecoins, active loans, real-world assets, demand for staking, and DEX trading expands. We're seeing a similar dynamic on Solana -- where ecosystem TVL is also at all-time highs and up nearly 40% over the last few months. 3. Stablecoins: USDT supply is up 9.4% this quarter. USDC is up 18%. ---- But what are the risks? Considering that global liquidity and stablecoin supply continued to expand well past the market cycle top in '21, what's the outlook for Q4? We shared an update with readers of @the_defi_report today If you'd like to check out the...

Show original

14.66K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.