Should native stablecoins pass yield back to ecosystems?

Starting with USDH and USDM, yield sharing stablecoins could dominate.

I asked @Sei_Labs Research to model this out.

Our conclusion: yield sharing stablecoins are inevitable IF they can clear the regulatory hurdles.

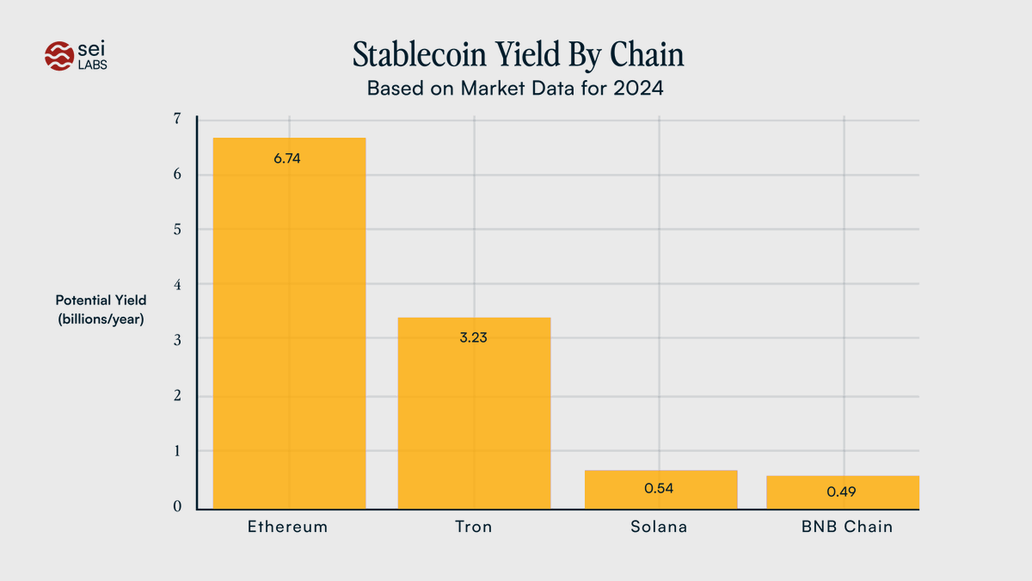

Stablecoins generate massive amounts of yield based on the underlying assets they hold as collateral

For some blockchains, this amount could be billions of dollars, with Ethereum and Tron the biggest drivers of this.

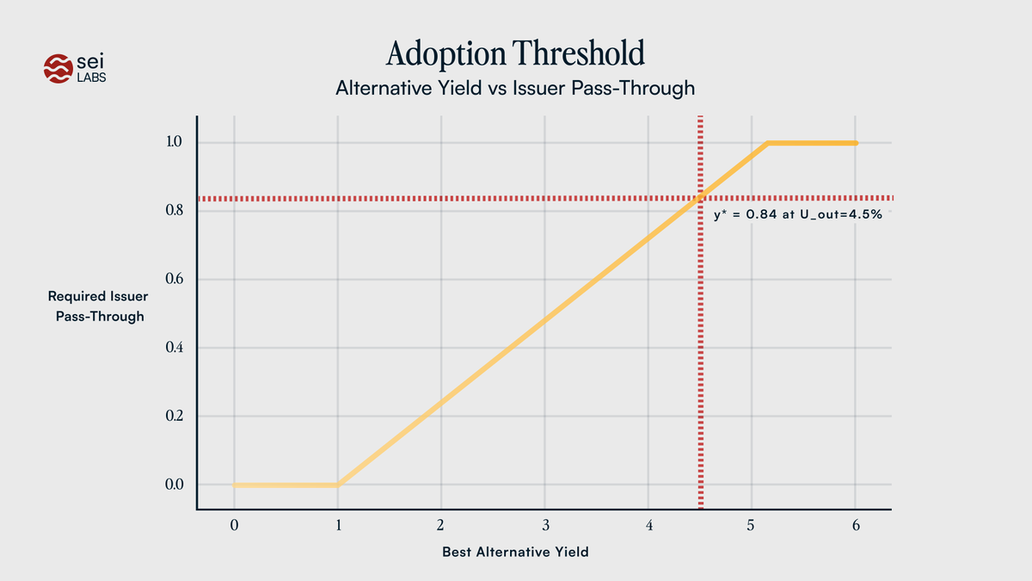

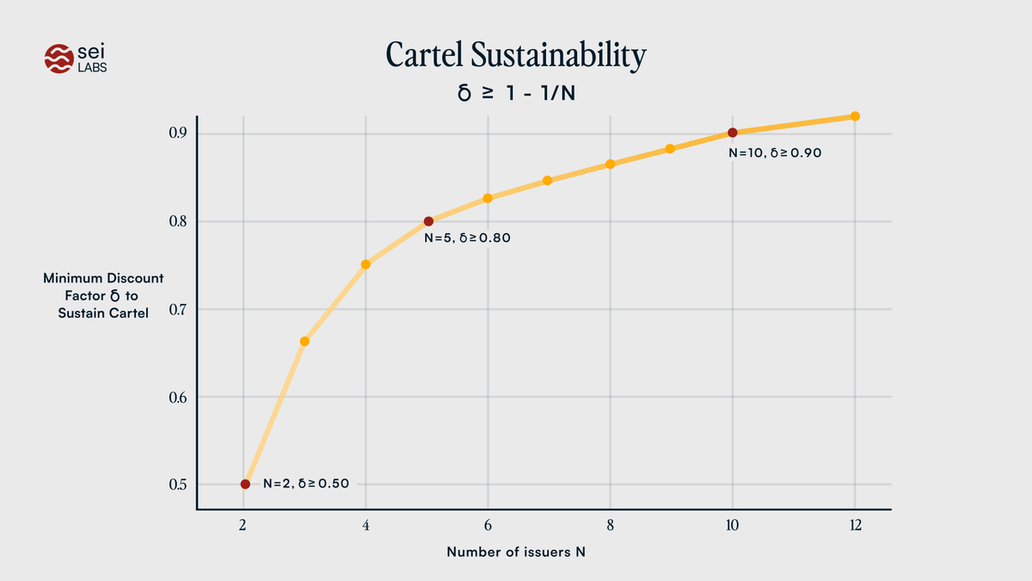

A game theory analysis shows that as stablecoins with yield sharing proliferate, issuers will have to increase the share of yield passed through to users.

As more competitors enter the the market, pressure on issuers mounts even further.

Even if all issuers act to minimize yield passed to users, the amount of required pass through will still increase and issuer margins will trend towards zero.

Stablecoin yield is non-trivial when compared to the fees earned by blockchains.

In 2024, the Ethereum blockchain earned $2.48 billion dollars from user fees.

As we saw above, stablecoins on Ethereum could have yielded as much as $6.72 billion, almost double that.

Assuming a world where yield-sharing stablecoins proliferate, the numbers are game-changing.

Currently 100% of yield is captured by issuers. At a realistic pass-through rate of 70% we see:

> Ethereum $4.72 billion

> Tron $970 million

> Solana $160 million

> BNB Chain $150 million

According to our game-theory analysis, yield sharing is inevitable.

But there are two real challenges that issuers of yield-sharing stablecoins will face: GTM and regulatory.

From a GTM POV, our analysis assumes that users and ecosystems will trend towards the stablecoin with the greatest yield-sharing.

This may not be the case.

Users may simply not care about yield sharing.

There are also many regulatory challenges to getting this into practice.

A blockchain can't simply issue its own stablecoin.

In reality stablecoins would have to be compliant with the GENIUS act.

Under GENIUS a legal entity needs to issue the coin on behalf of an ecosystem.

GENIUS explicitly prohibits passing yield on collateral directly through to users, requiring issuers to find novel ways of distributing this yield that won't run afoul of regulations.

Big banks in the US are actively working to stop this from happening.

The GENIUS act is under attack by the banking industry, who are trying to prevent stablecoins from threatening the banking industry.

Yield sharing stablecoins are a promising concept.

The potential of stablecoin yield is far, far, greater for ecosystems than that presented by user fees.

But will they become the industry standard? Right now it's hard to say.

I'm really curious to hear what the ecosystem thinks. Tagging some of the most interesting voices around stables:

@matthuang @aeyakovenko @VitalikButerin @0xBreadguy @drakefjustin @jon_charb @chameleon_jeff @0xMert_ @RyanSAdams @Nick_van_Eck @malekanoms @nic__carter @HadickM @sreeramkannan @tarunchitra @MaxResnick1

88.32K

169

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.