Top 7 important DAO proposals and discussions this week. 🧠

- Arbitrum's new Security Council

- Aave's new project

- Hyperliquid HIP-5

- zkSync new $ZK tokenomics

- Balancer's hack recap

- Jupiter's $JUP burn

- Orderly Network $ORDER buybacks

@aave DAO renewed its agreement with @bgdlabs to remain its core development and security partner until April 1, 2026, and introduced Project E, a new BGD initiative using Aave’s licensed tech under a revenue-sharing model.

@HyperliquidX community proposed HIP-5 to create Assistance Fund 2 (AF-2) ,a staker-governed buyback pool using 1-5% of Hyperliquid fees to purchase Strict List tokens (PURR, HFUN).

Funds accrue in USDC, with HYPE stakers voting in real time on which tokens to support. A 5% allocation equals about $55M/year in buybacks, while AF-1 retains 94% of fees.

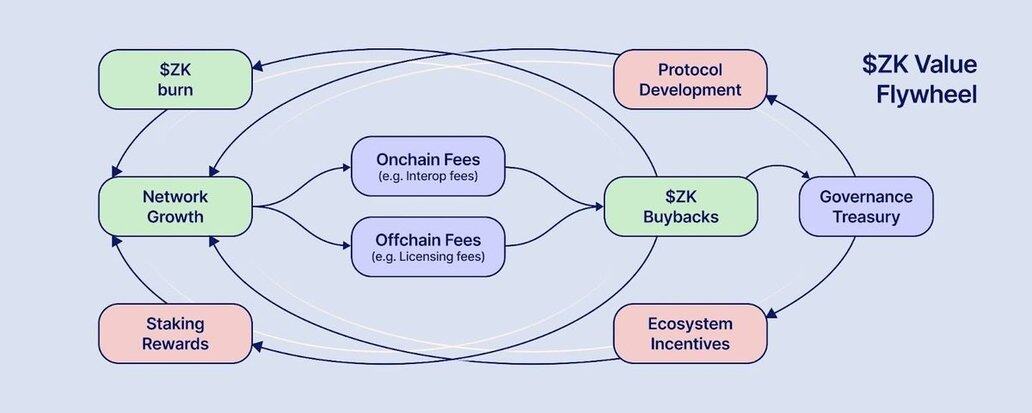

@zksync proposed a new $ZK tokenomics adding economic utility through interoperability fees and enterprise licensing, with revenues cycling into staking, burns, and ecosystem funding.

@Balancer’s V2 liquidity vaults were exploited on Ethereum, Base, Polygon, and Arbitrum, with over $100M stolen.

The issue affected only Composable Stable Pools. Balancer V3 and other pools were safe.

The cause is suspected to be either a faulty access control in the 'manageUserBalance' function or price invariant manipulation.

Over 27 Balancer V2 forks were also impacted. Losses included $3.4M from Sonic’s Beets, $283k from Optimism’s Beethoven.

@berachain validator intentionally halted the network and executed a successful emergency hard fork to recover ~$12M in user funds from their BEX.

@stakewise_io DAO’s emergency multisig recovered about 5,041 osETH (~$19M) and 13,495 osGNO (~$1.7M) from the exploiter.

@OrderlyNetwork started using 60% of its fees to buy back $ORDER.

9,62 mil

7

El contenido de esta página lo proporcionan terceros. A menos que se indique lo contrario, OKX no es el autor de los artículos citados y no reclama ningún derecho de autor sobre los materiales. El contenido se proporciona únicamente con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo vinculado para obtener más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. El holding de activos digitales, incluyendo stablecoins y NFT, implican un alto grado de riesgo y pueden fluctuar en gran medida. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti a la luz de tu situación financiera.