Since the beginning of 2024, Pendle's TVL exploded from ~$230m TVL to a peak of $13b TVL during September.

With a 500% TVL growth and ascension to top 10 DeFi protocols by TVL, there's MULTIPLE factors that fit together to make things work.

Intern's thought? Stablecoins.

👇

Stablecoins are one of the largest growing DeFi verticals, more than doubling in size since 2024 to $300b.

With entries from @BlackRock and @FTI_US, its a highly valued innovation frontier from some well-known institutional players.

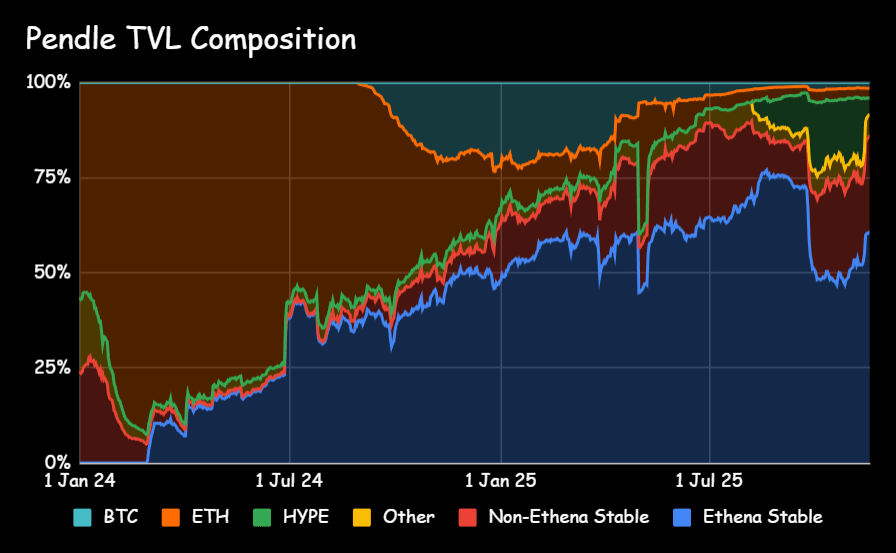

With the expansion of stablecoins on chain, its interesting to observe Pendle's TVL composition has seen a similar evolution.

Why, we hear you ask?

Our product suite naturally morphs with market supply/demand. As more stables enter the market, more stables enter Pendle.

Our highest impact integration is arguably @ethena_labs whose USDe-related pools contributed $9.3b TVL at its peak.

With over $4b PT supply put to use as collateral on money markets, Pendle x Ethena PTs are a critical component for much of DeFi today.

In the same timespan, non-USDe-related stablecoin TVL has also grown immensely, from $60m initially to a peak of $1.6b.

With diversification across multiple key pools, this component of TVL is largely insulated from large maturity events.

As new narratives are born and DeFi continues to evolve, Pendle v2 will evolve alongside it.

The reality is we're in EARLY STAGES for DeFi innovation and there's no telling what the next narrative will be.

There's only positioning yourself to catch it when it comes.

Pendle

7.38 K

68

El contenido al que estás accediendo se ofrece por terceros. A menos que se indique lo contrario, OKX no es autor de la información y no reclama ningún derecho de autor sobre los materiales. El contenido solo se proporciona con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo enlazado para más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. Los holdings de activos digitales, incluidos stablecoins y NFT, suponen un alto nivel de riesgo y pueden fluctuar mucho. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti según tu situación financiera.