We've partnered with Kemet Trading to offer clients access to derivatives trading infrastructure

Digital asset trading infrastructure provider Kemet now brings advanced derivatives trading technology to our institutional clients

We've partnered with Kemet Trading, the industry's leading digital asset derivatives trading platform for institutions, to provide our institutional clients with access to Kemet's derivative trading infrastructure. The collaboration provides our institutional clients with Kemet's sophisticated position, risk and portfolio management capabilities.

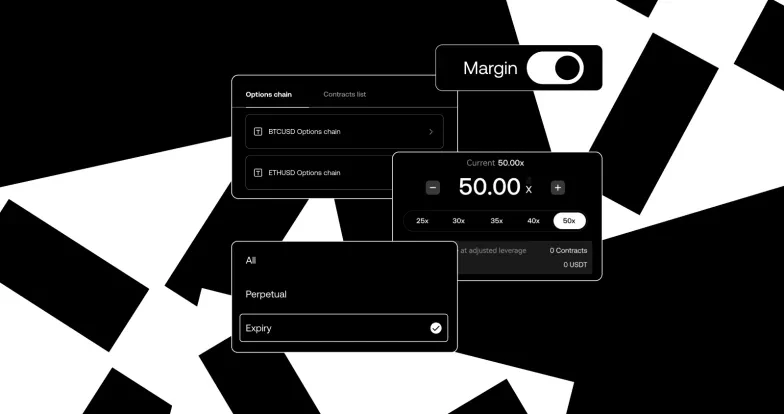

As institutional participation continues to drive market maturity, the integration provides essential infrastructure for complex trading strategies across futures, perpetuals and options markets.

Kemet's turnkey, all-in-one technology platform supports the full trade lifecycle with high-performance execution and risk management capabilities through a full suite of APIs, enabling institutions to execute across the entire digital asset derivatives market from a single endpoint. The platform's advanced algorithmic execution capabilities, including delta hedging, chase, vega, MLO (multi-leg order) and TWAP (Time-Weighted Average Price) can now be utilized by institutions across OKX's derivatives markets.

OKX Institutional, our exchange's comprehensive suite of solutions for institutions and professional traders, processes over US$1 billion in daily options trading volume. Our exchange offers portfolio margin mode that allows institutions to use any coin as collateral and offset positive delta on options to hedge futures or perpetuals positions. Through our risk offset mode, clients benefit from lower margins and efficient capital management. Our platform also supports multiple off-exchange custodial solutions through partnerships with industry leaders such as Copper and Komainu.

Since launch less than a year ago, Kemet has processed over US$8 billion in trading volume through its proprietary algorithmic Order and Execution Management System (OEMS). The platform ensures best execution through market-wide connectivity and end-to-end digital asset orchestration and automation.

© 2025 OKX. Se permite la reproducción o distribución de este artículo completo, o pueden usarse extractos de 100 palabras o menos, siempre y cuando no sea para uso comercial. La reproducción o distribución del artículo en su totalidad también debe indicar claramente lo siguiente: "Este artículo es © 2025 OKX y se usa con autorización". Los fragmentos autorizados deben hacer referencia al nombre del artículo e incluir la atribución, por ejemplo, "Nombre del artículo, [nombre del autor, si corresponde], © 2025 OKX". Algunos contenidos pueden ser generados o ayudados por herramientas de inteligencia artificial (IA). No se permiten obras derivadas ni otros usos de este artículo.